Discounted future cash flow calculator

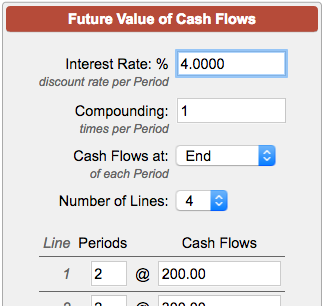

We discount our cash flow earned in Year 1 once our cash flow earned in Year 2 twice and our cash flow earned in Year 3 thrice. Cash Flow Templates This is our small assortment of professional cash flow spreadsheets.

Discount Rate Formula How To Calculate Discount Rate With Examples

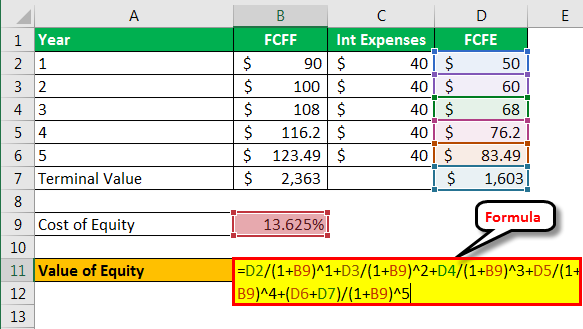

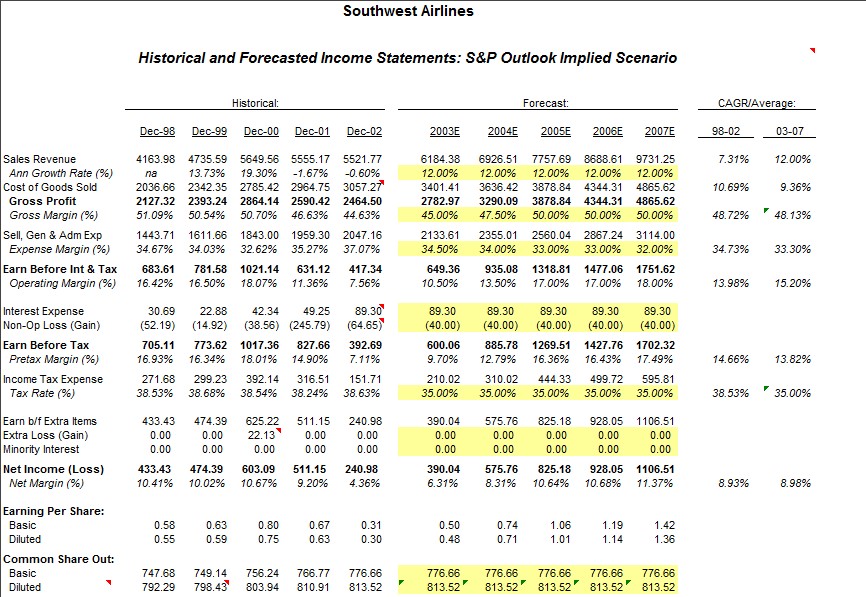

By adding the companys free cash flow to firm or the earnings per share to the discount rate WACC we can find out if the current price of a security or business is cheap or expensive.

. But other than this distinction the calculation steps are the same as in the first. The reason for this is that the effects of debt financing have been removed namely interest expense the tax shield ie savings from interest being tax-deductible and principal debt repayments. Online calculators and converters have been developed to make calculations easy these calculators are great tools for mathematical algebraic numbers engineering physics problems.

Given that one of the main use-cases of FCFF is for projection models most notably the discounted cash flow DCF each item must be expected to be ongoing into the future. Two Main Methods to Forecast Free Cash Flows. Where i - denotes the discount rate used n - denotes the time period relating to the cash inflows.

So the two parts of the calculation the cash flow and PV factor are shown above. How to Calculate FCFE. The discounted cash flow stock valuation calculator is relatively straightforward but allows customization with advanced options.

It also signals that the company has the cash to reduce its debt or fund future expansion or pay dividends to its. Beta is the covariance of the return of an asset divided by variance of the return of the benchmark over a certain time period and formula for this can be written as-. The discounted cash flow uses the Free cash flow of the company to forecast the future FCFs and discount rate to find its present value.

This rate of return is discounted from the future cash flows. Other than FCF dividends or EPS are also widely used to find the discounted cash flow. Once we calculate the present value of each cash flow we can simply sum them since each cash flow is time.

Cash flow planning and cash flow report are the templates you can download below. This calculator uses future earnings to find the fair value of stock shares. This calculator finds the fair value of a stock investment the theoretically correct way as the present value of future earnings.

We can conclude from this that the DCF is the calculation of the PV factor and the actual. In our previous post we discussed the meaning and calculation of free cash flow to firm FCFF which is often referred to as unlevered free cash flow. Annual Cash Flow Calculator.

Beta not only evaluate the risk associated with a particular stock but also used to evaluate the expected rate on returns and Discounted cash flow evaluation. The higher the discount rate the lower the present value of the future cash flows. Discounted cash flow is more appropriate when future conditions are variable and there are distinct periods of.

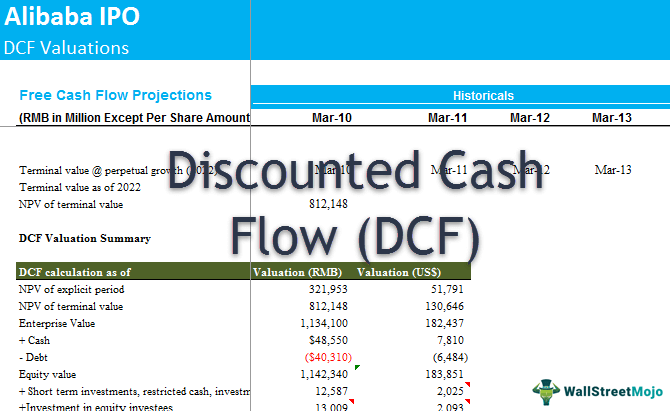

The Discounted Cash Flow method uses Free Cash Flow for a set number of years either 5 10 or so on and then discounts those cash flows using the Weighted Average Cost of Capital to reach a certain valuation for the company. Future cash flows are discounted at the discount rate. Among the income approaches is the discounted cash flow methodology that calculates the net present value NPV of future cash flows for a business.

Discounted Cash Flow Calculator Business valuation BV is typically based on one of three methods. Using the Online Calculator to Calculate Present Value of Cash Flows. Discounted cash flow DCF is a valuation method used to estimate the attractiveness of an investment opportunity.

The current worth of a future sum of money or stream of cash flows given a specified rate of return. Enter a trailing 12 month earnings per. Cash Flow Projection Example.

Created by professionals with years of experience in handling private and professional finances these free excel templates have been downloaded times since 2006. Using the Discounted Cash Flow Calculator. Using the Discounted Cash Flow calculator.

DCF analyses use future free cash flow projections and discounts them using a. Future value is the balance an account will accrue over time. The discretionary line items that pertain to only one specific group eg dividends should also be excluded.

Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor for a defined period of time in exchange for a charge or fee. Future value calculator with cash flow periodic additions or withdrawals inflows or outflows. The income approach the cost approach or the market comparable sales approach.

Determining the appropriate discount rate is the key to valuing future cash flows. Expanding the Advanced Options tab allows you to use Free Cash Flow instead. 235 KB 3415 downloads.

Cash Flow Diagram Generator. Intrinsic value of future cash flows for a business stock investment house purchase etc. You can find company earnings via the box below.

Our online Discounted Cash Flow calculator helps you calculate the Discounted Present Value aka. Discounted cash flow is a widely used method of valuation often used for evaluating companies with strong projected future cash flow. By reading this article you will understand what the.

The other cash flows will need to be discounted by the number of years associated with each cash flow. This means the higher the discount rate the lower the present value of future cash flows. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

Discounted Cash Flows Calculator. We only have templates as of today. Cash Flows Per Year.

This transaction is based on the fact that most people prefer current interest to delayed interest. Allows for different compounding periods. There are two ways to develop financial free cash flow projections into the future.

DCF is a popular absolute stock valuation calculation technique to find the intrinsic value of the stocks. Estimate the total future value of an initial investment of any kind. The discounted cash flow calculator is a fantastic tool that investment analysts use to determine the fair value of an investment.

Direct Method All required cash flow lines are forecasted directly based on a line of thinking which lists the line items of cash coming in and cash coming outIt is the quickest method to build a free cash flow forecast. Present value is the amount of money needed to generate a specific return. Calculate future value with payments with this versatile FV calculator.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Go for an automatic tool to calculate PV of cash flows if you want to be sure that your calculations are quick and precise. Discounted Cash Flow or DCF is the Actual Cash Inflow 1 in.

Future value of annuity calculator. By default it uses Earnings per Share to run valuations. The table is structured the same as the previous example however the cash flows are discounted to account for the time value of money.

Essentially the party that owes money in the present purchases the right to delay the payment until some future date. 250 KB 4634 downloads. Here each cash flow is divided by 1 discount rate time period.

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Discounted Cash Flow Analysis Street Of Walls

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

The Discounted Cash Flow Dcf Valuation Method Magnimetrics

Discounted Cash Flow Analysis Study Com

How To Use Discounted Cash Flow Time Value Of Money Concepts

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Discounted Cash Flow Calculator Calculate Dcf Of A Stock Business Investment

Future Value Of Cash Flows Calculator

Discounted Cash Flow Model Formula Example Interpretation Efm

Discounted Cash Flow Calculator Dcf

How To Calculate Discounted Cash Flow For Your Small Business